“First of all, yes, you can certainly leave money to the people and causes you care about—but the truth is that those people and causes would be better off getting your wealth sooner rather than later. Why wait until after you die?”

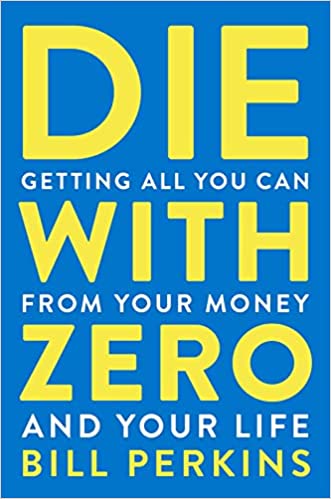

― Bill Perkins, Die with Zero: Getting All You Can from Your Money and Your Life

My father was born in 1912 and my mother five years later. They were true children of the Great Depression and by my count, also lived through three or four recessions that caused unemployment and hard times in our extended family. My parents “knew the value of a dollar” and impressed that into our minds, rarely taking us out to dinner because “why pay someone to do that when you can make the meal at home for a fraction of the cost?”

My dad only saw other continents while wearing the uniform supplied by the US Navy. Mom left the country once, to assist my sister after the birth of mom’s first grandchild. All told, I think they visited about 12 U.S. states. They were thrifty and I believe lived in fear of running out of money.

This attitude also helped me because I was – at my father’s insistence (“What? Are you crazy? Put your money in these accounts.”) – an early adopter of the Individual Retirement Accounts and 401ks, that came with matched dollars from my employer. As a result of their lessons, my wife and I have accumulated a comfortable amount of money that most certainly will outlive us.

Or maybe not.

I recently finished reading Bill Perkins’ “Die With Zero.” The book has profoundly affected my thinking about spending money.

Perkins’ premise is that we spend too many hours accumulating wealth and not enough time enjoying it – either by spending on ourselves, our children and friends, or by donating it to causes we believe in.

He illustrates with the example of a person, age 63, who amasses $1 million in net worth at the end of their life at 88 years old. And then the person divides the money among three children and a charity they support. Each child and the charity get $250,000. But by this time, the children are in their late 50s or 60s. While the charity welcomes the donation, it has managed to struggle along with nothing for 25 years. The children have put their children through college, often by delaying their own pleasures as they scrimp and save.

How much better, Perkins asks, would all those lives be if they had some of that money to enjoy now?

After all, most of us have albums filled with photos from great family vacations. No one has a scrap book with their stock portfolio. The photo album is the “memory dividend” and it is far more significant than the other dividends.

So we have begun to make fundamental changes in the lives of our children:

- We are sending one on a group trip to Zion National Park – long a dream of his – with a crowd of only people under the age of 30. He’ll see a place he’s always wanted to see and make some new friends.

- Another child will get a terrific trip to Northern California to see baseball games with her friends and experience a city she’s never seen.

We have worked hard for decades and been fortunate enough to accumulate some money. And we are not going to die with it.

My wife and I have planned three trips during 2022 to places we have wanted to see. And we are not staying in Motel 6 either. We are making pledges and payments to causes we support.

0 Comments